Let’s get one thing straight. The circus is in town, and its main attraction is a digital token called XRP. Everyone—from Wall Street suits at Standard Chartered to anonymous traders tweeting rocket emojis—is convinced this is the big one. They’re whispering about a $5 xrp stock price, a future where Ripple’s coin powers the global financial system, and an SEC approval for a spot ETF that’s supposedly a 100% sure thing. XRP Price Shakeup: Whales, Legal Wins & ETF Hype Fuel Bold $5 Forecasts.

You can almost smell the ozone in the air, that electric tension before a lightning strike. The hype is deafening. But if you listen closely, underneath all the noise, you can hear a very different sound: the heavy, rhythmic thud of a back door swinging open as the smart money quietly cashes out.

This isn’t a story about a revolutionary technology on the verge of a breakthrough. This is a high-stakes poker game where the house, the whales, and the regulators are all looking at their cards, and you, the retail investor, are the pot.

The Sure Thing That Ain't So Sure

The entire bull case for XRP right now hinges on one event: the imminent approval of a spot ETF. We're told it's a done deal. Bloomberg analysts, who I'm sure are very smart people, have put the odds at "near 100%." Prediction markets, which are just a fancy way for tech bros to gamble, agree. Everyone is buying the rumor.

But let's be real for a second. Are we supposed to believe the SEC, an agency that spent years and millions of taxpayer dollars trying to sue Ripple into oblivion, has suddenly become a friendly, rubber-stamp committee? They settled their case, sure, for a cool $125 million fine—a rounding error for Ripple—and now all is forgiven? This is the same government that can’t pass a budget without a multi-week soap opera. And we're supposed to believe they've streamlined their crypto ETF approval process into a foregone conclusion? Give me a break.

This whole narrative feels manufactured. It’s like a movie trailer cut to perfection, showing all the best explosions while hiding the fact that the plot makes no sense. The pro-crypto political winds, the conveniently timed Trump comments, the Ripple execs winning awards in London… it’s all just a little too neat. It's the kind of story you tell people to get them to buy something. The question is, who’s doing the selling?

Follow the Money—Right Out the Exit

While the "XRP Army" is busy drawing charts to $5 and beyond, the whales—the massive accounts that actually move this market—are hitting the "sell" button like their lives depend on it.

We’re not talking about a little profit-taking. We’re talking about a fire sale. Data shows a staggering $50 million worth of XRP leaving whale wallets every single day. XRP Price on Edge as $50 Million Daily Whale Selling Threatens ETF Optimism. One whale recently dumped nearly half a billion dollars' worth of the coin in a single move, triggering a cascade of liquidations that wiped out $500 million in long positions.

This is the part of the movie where the ship’s architects are seen quietly lowering themselves onto lifeboats while the band plays a cheerful tune on the deck for the passengers. What do these whales know that the rest of the market is so desperate to ignore? Are they just taking profits before a predictable "sell-the-news" event, where the price tanks the moment the "good news" of an ETF approval actually hits? Or do they suspect this "100% certain" approval ain't so certain after all?

I don't have the answer, and anyone who tells you they do is lying. But I know this: when the people with the most to gain are selling into the biggest hype cycle a coin has seen in years, you have to ask yourself if you’re the one holding the bag. It’s a classic tale. The insiders get rich, and the believers get wrecked. We’ve seen it with Dogecoin, we’ve seen it with a thousand other dead projects and we'll see it again.

A Chart Full of Contradictions

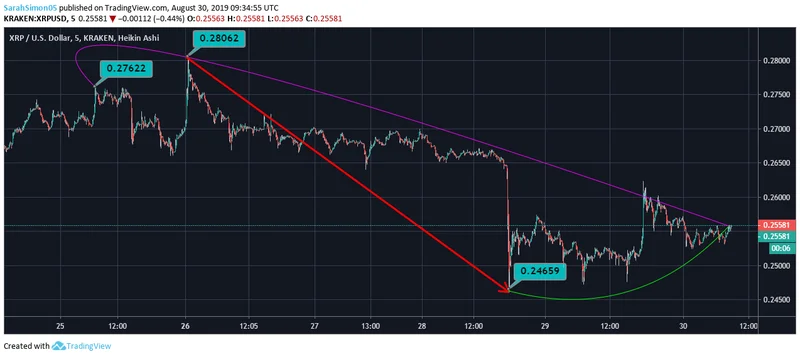

Then you have the technical analysts, God bless 'em. They’re staring at the XRP price today charts like they’re ancient scrolls that hold the secrets of the universe. And, surprise, they see whatever they want to see.

On one hand, you have veteran trader Peter Brandt pointing to a bearish "descending triangle." He says if XRP breaks below its key support around $2.80, we could be looking at a plunge down to $2.20. That's a nasty drop, and his logic is sound—the price has been making lower highs since its summer peak.

On the other hand, the bulls see a massive "inverse head and shoulders" pattern, a coiled spring ready to launch the price past its old all-time high of $3.84 and into uncharted territory. They say a break above $3.70 opens the door to $4, $5, and beyond. So which is it? Is XRP about to crash, or is it about to go to the moon?

This is a bad setup. No, "bad" doesn't cover it—this is a textbook recipe for volatility and pain. The chart is a mess of conflicting signals because the market itself is schizophrenic, torn between pure, unadulterated hype and the cold, hard reality of massive selling pressure. The chart isn't telling you what's going to happen. It's just a mirror reflecting the market's total confusion. And the retail crowd, well they're just hoping for the best.

Bitcoin's recent run to $125,000 was fueled by actual ETF inflows. The Ethereum price has been climbing on the back of real network usage. XRP, meanwhile, is running on fumes and a prayer. Offcourse, a prayer can sometimes be answered. But usually, it’s just noise before the inevitable silence.

So, Who's Getting Played Here?

Let's cut the crap. This whole XRP saga isn't about fundamentals or technology. It's a beautifully orchestrated piece of financial theater. The ETF narrative is the plot, the analysts are the chorus, and the whales are the producers cashing their checks before the final act. Whether the SEC approves the ETF or not is almost irrelevant. The game is the volatility itself. The big money makes a killing on the wild swings up and down, fueled by the hopes and dreams of regular people who just want to catch a break. Maybe it goes to $5. Maybe it goes to $2. The only guarantee is that most people will get it wrong.