So, let me get this straight. SoundHound AI—a company whose stock chart looks like an EKG during a heart attack—jumps 10% in a morning because an insurance company in France decided to buy more of its software. And we’re supposed to treat this like the second coming of AI? Give me a break.

Every time a stock like SOUN pops, the headlines write themselves. "AI Specialist Soars!" "Huge Vote of Confidence!" It’s a Pavlovian response from a market that’s been trained to salivate at the mere mention of "artificial intelligence" and "productivity." The trigger for this latest feeding frenzy was a press release announcing that Apivia Courtage, a company they were already working with, is expanding its use of SoundHound’s Amelia AI platform, a move that has analysts asking, As SoundHound Announces New Apivia Deal, Should You Buy, Sell, or Hold SOUN Stock?.

The magic number they’re throwing around is a "20% productivity increase." I can just see the marketing team in a sterile, glass-walled conference room, high-fiving over that bullet point. It sounds incredible. It sounds transformative. But what does it actually mean? Is it 20% fewer human agents? 20% faster call resolution? 20% more customers getting stuck in an automated phone tree before hanging up in a rage? The details, as always, are conveniently vague.

This isn’t a knock on Apivia. They probably got a decent system that helps them handle boring insurance calls. Good for them. But using this single data point from an existing customer to justify a massive spike in a multi-billion dollar company's valuation is just insane. It's like a food truck bragging that its one regular customer ordered an extra taco. It’s nice, but is it a sign of a global taco empire? I don’t think so.

The Hype Train Has No Brakes

Let’s be real. The Apivia news is just the excuse, not the reason. The real engine driving this train is the all-consuming, logic-defying hype vortex surrounding anything remotely connected to AI. SoundHound’s stock is also getting a nice little bump because of completely unrelated news about AMD striking a deal with OpenAI, leading some to ask, Is SoundHound AI Stock (SOUN) Surging on AMD-OpenAI News?.

This is just speculation. No, "speculation" is too kind—it's pure, uncut FOMO coursing through the veins of the market. Traders see "AI" and "deal" in the same sentence and just start smashing the buy button, hoping to catch the same lightning that Nvidia and OpenAI bottled. SoundHound is a boat, a pretty leaky one at that, being lifted by a tidal wave created by aircraft carriers. Are we really supposed to believe that a GPU deal between two tech titans has any fundamental bearing on SoundHound’s business model of selling call center software?

It’s the same dumb logic my crypto-bro cousin uses, thinking his meme coin is the next Bitcoin just because Elon Musk tweeted a picture of a dog. The connection is imaginary, a fantasy cooked up by people who are chasing momentum, not value. And offcourse, the options traders are all over it, signaling a "bullish trend." Of course they are. They aren't investing; they're gambling. They’re betting on hype, on irrationality, on the hope that there's a bigger fool out there willing to pay more tomorrow for the same story.

This whole situation reminds me of the dot-com bubble, where companies with no profits and a ".com" in their name were worth more than Ford. We’re doing it all over again, just with ".ai" this time. Who needs profits when you have a narrative? Who needs a sustainable business when you have a press release?

A Look Under the Hood Reveals a Mess

If you peel back the layers of hype and actually look at SoundHound’s financials, the story gets a lot darker. Sure, revenue is up. Way up—217% year-over-year in the last quarter. But that’s what happens when you go on a shopping spree and buy other companies like Amelia and Interactions. It’s called growth-by-acquisition, and it's a great way to make your top-line numbers look spectacular.

But look one line lower on the balance sheet. The company’s losses are getting worse. They lost $0.19 per share, up from $0.11 a year ago. How, in God's name, do you more than triple your revenue and still manage to lose more money? Where is it all going? It’s a classic growth-at-all-costs strategy, but at some point, the "costs" part of that equation starts to matter.

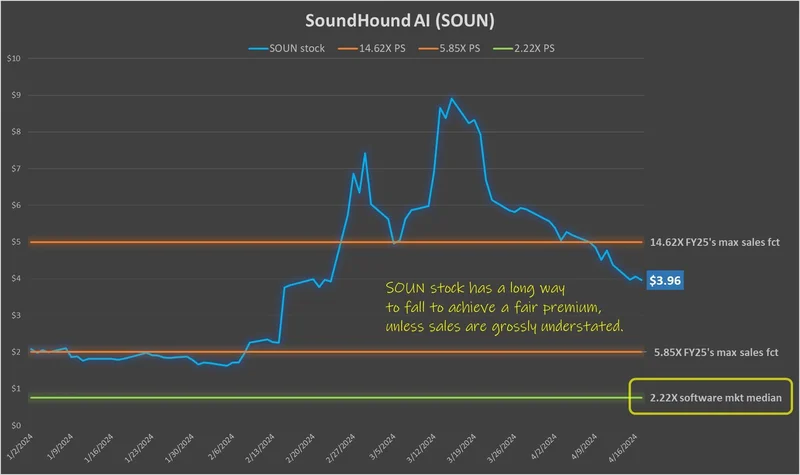

And the valuation is just comical. Depending on who you ask, the stock is trading at 37 to 85 times next year's sales. That’s not just optimistic; it’s delusional. You’re paying a premium for a company that is burning cash at an accelerating rate. They talk about building a "defensible moat" by acquiring other tech, but all I see is a company digging a deeper and deeper hole with a golden shovel, and honestly...

This isn't a business; it's a story. It's a collection of buzzwords—conversational AI, enterprise solutions, digital transformation—strung together to attract capital. And for now, it's working. The stock is flying, the analysts are slapping "Moderate Buy" ratings on it even as it blows past their highest price targets, and everyone is pretending this is normal. But a story can only carry you so far before reality kicks in.

So We're Just Pretending This Makes Sense?

At the end of the day, here's what we have: a company with worsening losses and a valuation that belongs in a science fiction novel. Its stock is soaring based on an expanded deal with one existing client and the residual hype from completely unrelated tech giants. This isn't an investment thesis. It's a high-stakes game of musical chairs, and right now the music is blasting. But when it stops, and it always does, a lot of people are going to be left without a seat, wondering how a story about "productivity" left them with nothing.