It’s easy to get lost in the noise surrounding a giant like Verizon. You see the headlines, the stock tickers, the endless stream of analyst ratings flickering across your screen. One day, a BNP Paribas Trims Verizon Stock (VZ) Price Target over Dull Outlook on Leadership Shakeup. The next, another firm sees the same change as a brilliant strategic move. The stock itself seems adrift, bobbing in a sea of uncertainty, barely positive for the year while rivals seem to be eating its lunch in the cutthroat consumer wireless game.

I get it. From that perspective, the picture looks… well, dull. It looks like an old-world titan struggling to find its footing in a rapidly changing arena. But I’m here to tell you that this perspective, the one obsessed with quarterly postpaid phone subscriber numbers, is like trying to understand the dawn of the internet by counting the number of fax machines sold. It’s a colossal failure of imagination.

We’re all staring at the flickering shadows on the cave wall—the market share squabbles, the C-suite shuffles—while a technological bonfire is being lit right behind us. And that fire is about to reshape the entire landscape of what it means to be connected.

The Myopia of the Market

Let’s be direct about the skepticism. An analyst from BNP Paribas, Sam McHugh, recently downgraded the stock, arguing that the leadership change from Hans Vestberg to former PayPal CEO Dan Schulman "raises questions about the company’s strategy" and its willingness to "defend its market share."

With all due respect to the meticulous work these analysts do, this is precisely the wrong question to be asking. Defend market share? That’s a checkers move in a world where Verizon is quietly setting up the board for three-dimensional chess. The battle for subscribers with T-Mobile, Comcast, and Charter is the story of today. It’s a necessary, but ultimately distracting, ground war. The real story, the one that will define the next decade, isn’t happening in terrestrial cell towers. It’s happening 300 miles above our heads.

When I first read about Verizon’s deal with AST SpaceMobile, I honestly just sat back in my chair, speechless. On the surface, it sounds like another corporate partnership. But the reality is so much more profound. They are integrating AST’s low-Earth-orbit satellite network directly into their terrestrial service. Let me offer a clarifying self-correction here, because the jargon can obscure the magic: in simpler terms, this means your standard, off-the-shelf smartphone will soon have a satellite connection. Everywhere.

This isn’t about getting a signal in a national park, it’s about a future where agricultural sensors in the most remote Nebraskan fields can optimize water usage in real-time and emergency responders have unbreakable communication lines during a wildfire in rural California and a shipping vessel in the middle of the Pacific can transmit logistical data as easily as if it were docked in Manhattan—it’s a complete paradigm shift in what we consider basic infrastructure.

A New Map Is Being Drawn

Think about the last time we saw an infrastructure project of this magnitude. This feels like the laying of the first transcontinental railroad. The investors back then who were fixated on the quarterly profits of stagecoach companies completely missed the point. The railroad wasn’t just a faster stagecoach; it was a technology that compressed the continent, created new cities, and enabled entire industries that were previously unimaginable. It redrew the map of the possible.

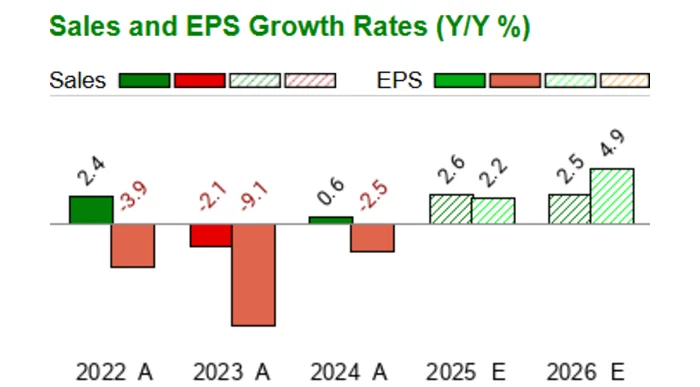

That’s what ubiquitous, direct-to-device connectivity is. It’s a new utility. It’s the foundation upon which the next generation of the internet of things, autonomous logistics, and remote work will be built. And while Wall Street is wringing its hands over a 0.6% dip in the stock price, the pieces for this new world are being locked into place.

Of course, with this kind of power comes immense responsibility. As we erase the last remaining dead zones, we have an ethical obligation to ensure this new layer of connectivity doesn’t just benefit the powerful, but that it truly serves to bridge the digital divide for rural and underserved communities. This can’t just be a tool for industry; it must be a platform for universal progress.

This long-term, foundational vision is, I believe, what the cold, hard math is trying to tell us. A recent Discounted Cash Flow (DCF) analysis—a model that projects a company's future cash generation—suggests Verizon’s intrinsic value is somewhere around $127 per share. Today, it’s trading at about $40. How can such a massive gap exist? Because the market is pricing the company based on the old map. The DCF model, in its own emotionless way, is pricing in the new one. It’s calculating the value of a company that provides a fundamental utility for the entire nation, not just one that sells phone plans.

So, what does this mean for us, for you? It means we have to ask better questions. Instead of asking if Verizon can fend off T-Mobile next quarter, we should be asking: What new businesses will be born when reliable connectivity is as ubiquitous as the sky itself? How will our lives change when the concept of a "dead zone" becomes a relic of the past?

The Signal Through the Noise

Forget the daily stock chart. The real story isn’t about defending a market; it’s about creating a new one from scratch. While the world is tuned into the static of market competition, Verizon is building a transmitter powerful enough to cover a continent. The chatter is just noise. The satellite partnership, the quiet investment in foundational tech—that’s the signal. And it’s coming in loud and clear.