So, Qualcomm finally decided to show up to the AI party.

I saw the headlines—stock up 11%, a bold new plan to take on Nvidia and AMD in the data center. The usual breathless coverage from the finance blogs. You'd think they'd just invented cold fusion. Let’s all calm down for a second. This isn't some scrappy underdog story. This is a company that had its shot at the server market years ago and completely blew it. Now they’re back, waving around some PowerPoints about chips that won’t even ship until 2026, and we’re supposed to be impressed?

Give me a break.

Haven't We Seen This Movie Before?

I feel like I’m having the world’s most boring case of déjà vu. Back in 2017, Qualcomm partnered with Microsoft for a big, splashy run at the data center with their Centriq 2400 platform. Remember how that went? Yeah, me neither, because it vanished without a trace, crushed under the heel of Intel and a then-ascendant AMD. The company got distracted, bogged down in lawsuits, and the whole thing fizzled out.

So, what makes this time different? Their big pitch is "total cost of ownership," which is corporate-speak for "our chips use less electricity." They’re focusing on AI inference—the part where you run the AI models, not the heavy lifting of training them. This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of a strategy. They’re essentially conceding the most lucrative, high-margin part of the market (training) to Nvidia and AMD and hoping to carve out a niche by being the budget-friendly option.

It's like trying to compete with Ferrari and Lamborghini by releasing a really fuel-efficient go-kart. Sure, it’s cheaper to run, but is anyone who’s serious about winning the race even going to look at it? Why would a company building a billion-dollar AI infrastructure bet its future on a newcomer promising to save them a few bucks on their power bill, especially when that newcomer has a track record of bailing?

The Unbothered Kings on Their Thrones

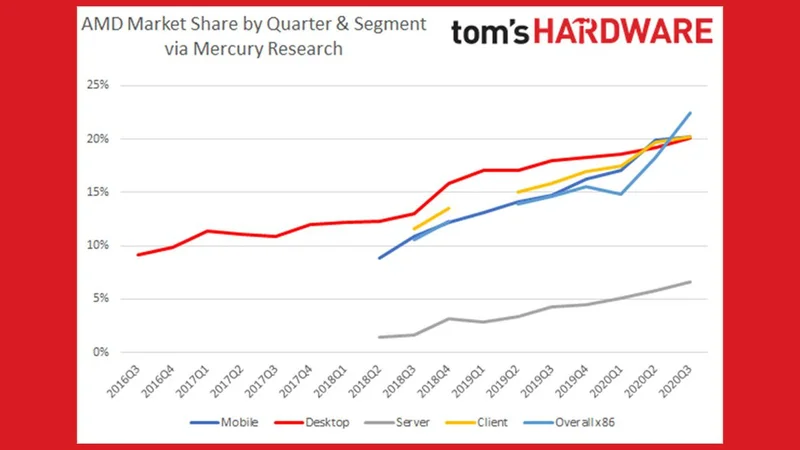

While Qualcomm was busy drafting its press release, AMD was… well, AMD was busy printing money and conquering the world. Their stock is at an all-time high. Analysts at places like Wedbush and HSBC are tripping over themselves to raise their price targets to absurd numbers like $270 and $310. AMD Shares Surge Amid Strategic Partnerships and Analyst Price Target Increases. Why? Because AMD is actually shipping product and signing monster deals.

Oracle is deploying 50,000 of their MI450 GPUs. Fifty. Thousand. That’s not a plan on a slide deck; that’s a warehouse full of hardware getting plugged in. They’ve got partnerships with Meta and OpenAI. They’re the real deal. When the news about Qualcomm’s grand entrance hit the wire, what happened to AMD’s stock? It went up. The market—the only opinion that actually matters—collectively shrugged. AMD Stock Is Unfazed by Qualcomm’s (QCOM) AI Server Plans. It was the financial equivalent of seeing a fly buzz around your head and not even bothering to swat it away.

Qualcomm showing up with its 2026 roadmap is like bringing a well-crafted PowerPoint presentation to a gunfight. AMD and Nvidia are aircraft carriers launching entire fleets of next-gen fighters every six months. By the time Qualcomm’s AI200 chip actually exists in the real world, it’ll be competing with two, maybe three, new generations of hardware from the incumbents. And they expect to make a dent? Offcourse they do. Every company has to project confidence, I get it. But this feels less like confidence and more like delusion.

This whole thing reminds me of the corporate buzzword bingo I used to play. "Synergy," "leveraging assets," "paradigm shift." Now it's "AI inference," "custom NPU," and "edge solutions." It's all just noise designed to make investors feel like something important is happening. It ain't working on me.

What’s even weirder is their pitch that rivals like Nvidia and AMD could become customers, buying individual chips. So the grand strategy is to compete with them while also hoping they buy your parts? That’s not a business plan; that’s just hoping your enemies take pity on you. They’re building a future on a product that won’t exist for two years, and by then the entire landscape will have changed, and... I just can't see how this ends well.

A Nice Little Hobby Project

Look, I get it. The AI gold rush is on, and every company with a C-suite and a stock ticker feels like they need to be selling shovels. But this move from Qualcomm feels less like a serious competitive threat and more like a desperate attempt to convince Wall Street they haven't been left completely in the dust. The 11% stock pop tells me it worked, for a day.

But AMD isn’t losing sleep over this. Nvidia isn’t redesigning its roadmap. They are in a two-horse race for the soul of the next generation of computing. Qualcomm isn't a third horse; they’re a spectator who just bought a ticket and is yelling from the stands that they plan to start training a pony in a couple of years. Maybe they’ll sell a few chips. Maybe they’ll find a small niche. But a real competitor to the throne? Not a chance.