So, a new crypto token called ChainOpera AI (COAI) just ripped off a 1,757% gain in a single week, a performance that landed it among the 3 Altcoins That Crushed the Market in October 2025’s Second Week. A billion-dollar market cap materialized out of thin air. The charts look like a rocket launch, and the crypto bros on X are probably posting astronaut emojis until their thumbs bleed.

And I’m supposed to be impressed? Give me a break.

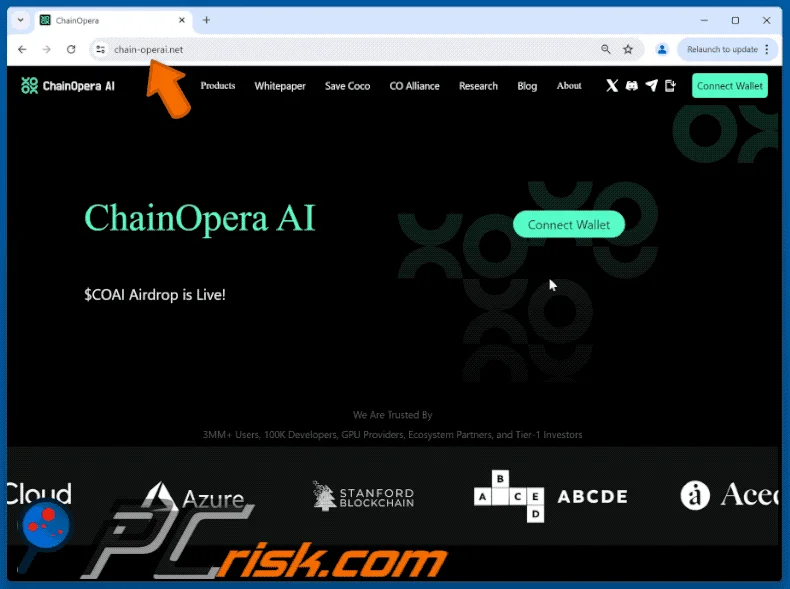

I’ve seen this movie before. We all have. A shiny new project bolts some buzzwords together—this time it’s “AI” and “decentralized intelligence”—tacks itself onto a hot ecosystem like Binance’s BNB Chain, and waits for the retail suckers to pile in. It’s the oldest story in the crypto playbook, updated for the current hype cycle.

They tell us this explosion is because of a listing on some decentralized exchange, a surge in "positive discussions," and the project's supposed 3 million "AI users." It's a perfect storm of narrative-driven nonsense designed to distract you from the only thing that actually matters. This isn't a story about revolutionary technology. This is a story about math. And the math is terrifying.

A Perfectly Constructed Trap

Let’s get right to the guts of it, because the PR fluff is just window dressing. According to BscScan, the top 10 wallet addresses for COAI hold over 96% of the entire token supply.

Read that again. Ninety-six percent.

This isn't a decentralized project; it's a private party with a few bouncers at the door letting the public peek in. This is like playing a game of Monopoly where one person starts with all the hotels on Boardwalk and Park Place already built. It's not a game; it's a slaughter. The people who control those wallets can, at any moment they choose, dump their holdings and send the price to absolute zero in the time it takes you to refresh your screen.

One user on X warned the price could collapse to “below $0.01 in seconds.” This isn’t FUD (Fear, Uncertainty, and Doubt). This is just… arithmetic. When a handful of anonymous wallets control the entire supply, you aren't an "investor." You're the exit liquidity. You're the person holding the bag when the music stops.

And who are these people? Are they the founders? Early venture capitalists? A cartel of market makers? We don't know, and the project certainly isn't in a hurry to tell us. Why would they? The mystery is part of the allure, isn't it? It lets you dream that you’re getting in on the ground floor, when in reality, the building has already been built, and the owners are just waiting for the right moment to cash out and demolish it.

The project boasts about its "AI payment service" and its "300,000 BNB payers." Okay, but what does that even mean? How many are active? What are they paying for? These are just big, round numbers meant to sound impressive. It’s like a bad startup pitch where the founders talk about their potential market size instead of their actual revenue. It's all sizzle, no steak. And offcourse, the timing is just a little too perfect, riding the coattails of a "BNB Season." It’s a masterclass in narrative engineering.

The Illusion of Scarcity

The second part of this trap is the tokenomics. Only about 19.6% of the total 1 billion COAI tokens are even in circulation. This creates a wicked illusion of scarcity. The low circulating supply makes it incredibly easy to pump the price to absurd levels with relatively little capital. Everyone sees the ChainOpera AI (COAI) Price rocketing from $1 to $5 to almost $11 and gets a crippling case of FOMO.

But the fully diluted valuation (FDV) tells the real story. With a billion tokens in total, every dollar the price goes up adds a billion dollars to the project's theoretical value. This is how you get these insane market caps overnight. It’s not real value being created. It's a financial mirage.

What happens when the vesting schedule kicks in and millions of new tokens start unlocking every month? The so-called "scarcity" vanishes. The market gets flooded with supply from early insiders who got their tokens for pennies, or less. They don't need the price to go to $100. They're already rich at $1. They can sell all day long while you’re “HODLing” and praying for another pump. This is a bad setup. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire waiting for a gust of wind.

Speaking of bad setups, can we talk about the absolute nightmare of trying to read any of these source articles? I had to click through three different layers of cookie consent pop-ups just to see a price chart. "Strictly Necessary Cookies," "Performance Cookies," "Targeting Cookies." It’s an endless, user-hostile maze. It ain't about my privacy; it's about making it so annoying to opt out that you just click "Accept All" in a fit of rage. It’s the same psychological game as this token pump—wear down the user’s defenses until they make a bad decision.

The whole thing feels so… orchestrated. The DEX listing, the AI hype, the BNB narrative, the low float. It’s a textbook recipe for a pump, and what inevitably follows is the dump. The question isn't if it will happen, but when. And when it does, all the people cheering on the sidelines now will be gone, already moving on to the next shiny new token with a great story.

So, You're the Punchline

Look, I get the appeal. You see a 1,757% gain and you imagine what could have been. You think, "If I had just put in a thousand bucks..." But that's not investing. That's buying a lottery ticket after the winning numbers have already been announced. The insiders, the owners of those top 10 wallets, they’re the ones who won. If you're buying COAI now, at a billion-dollar valuation, you aren't playing to win. You're just providing the prize money for the people who already did. Don't be their exit liquidity.