Beyond Bitcoin: Why MARA's AI Pivot Isn't Just a Strategy, It's an Evolution

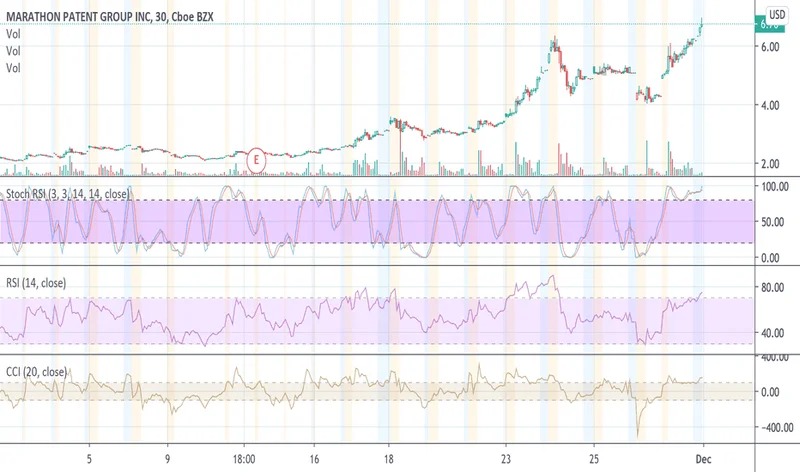

I've spent my career watching for those inflection points—the moments when a technology, or a company, turns a corner and becomes something more than what it was. We’re seeing one of those moments right now, and it’s hidden in plain sight, disguised as a volatile, misunderstood Bitcoin mining stock. The company is MARA Holdings, and if you’re only looking at its daily price swings—a gut-wrenching 7% drop one day, a soaring 30% gain over a month—you’re missing the real story.

The market is confused. It sees the insider trading rumors, the mixed earnings, the dizzying volatility, and it reacts with fear and uncertainty. But that noise, that chaos? That’s not a signal of failure. It's the sound of metamorphosis. When I first started digging into MARA’s recent moves, past the headlines about Bitcoin production, I honestly just sat back in my chair, speechless. This isn't a crypto company trying to hedge its bets. We are witnessing the birth of a new kind of digital infrastructure company, one that sits at the nexus of the two most powerful technological forces of our time: decentralized finance and artificial intelligence.

The Energy Bridge Between Two Worlds

For years, the playbook on MARA was simple: as Bitcoin goes, so goes MARA. The company’s core business was straightforward—turn massive amounts of electricity into digital gold. They got incredibly good at it, boosting production and becoming a major player in the mining industry. The market understood this model, priced it, and traded it based on the ticker price of BTC. But that model is now obsolete.

The company's "twist," as some reports are calling it, is its expansion into AI data centers. But calling it a twist is a massive understatement. This is a profound strategic leap built on a single, universal truth: the future runs on energy. MARA is leveraging its core competency—which isn't just mining Bitcoin, but the art of acquiring and managing colossal amounts of power efficiently—to fuel the AI revolution. In simpler terms, the complex, global infrastructure they built to power one digital revolution is perfectly positioned to power the next one.

Think of it like this: imagine the early days of the internet. You had companies laying down thousands of miles of fiber-optic cable just to carry dial-up signals. Then, seemingly overnight, the demand for broadband video streaming exploded. The companies that owned the physical cables, the actual infrastructure, suddenly held the keys to a kingdom they hadn't even known they were building. MARA is sitting on a 21st-century version of those fiber-optic lines. Its assets aren't just mining rigs; they are power agreements, energy infrastructure, and operational expertise. That is the real moat.

Reading the Static, Not the Signal

So why the panic? Why the volatility? Because the market is trying to read a futuristic blueprint using last year’s glasses. Analysts are looking at MARA’s financials—a bizarre mix of an incredible 157% EBIT margin alongside sluggish revenue growth and a cautious 0.5 current ratio—and they can't make sense of it. They see a stock trading at a discount to its peers, around 9x EV/EBITDA, and they see risk.

They’re asking the wrong questions. The numbers look strange because the company is in two different businesses at once, one mature and one embryonic. The market sees a confusing balance sheet with deferred taxes and debt, but what I see is the messy, beautiful, chaotic process of a caterpillar building its chrysalis—it looks like a tangled mess from the outside, but it’s the necessary, resource-intensive stage before it emerges as something entirely new.

This leads us to the questions we should be asking. What is the proper valuation for a company that powers both the decentralized ledger of the world’s hardest currency and the centralized intelligence of the world’s most advanced AI? How do you build a financial model for a business category that is being invented in real-time, right before our eyes? The truth is, you can't. Not with traditional metrics. The volatility we're seeing is the market's frantic attempt to price a paradigm shift.

Of course, this journey comes with immense responsibility. As we build these colossal energy hubs to power our digital future, the question of sustainability can't be an afterthought. MARA's focus on renewable energy is a critical first step, but for this entire sector, the ethical imperative must be to build a future that is not only intelligent and decentralized but also environmentally sound. We can't build a new world on the foundations of the old one's mistakes.

The Blueprint Is on the Table

Let’s be clear. This isn't just about one company's stock. What we're seeing with MARA is a potential blueprint for the future of industrial technology. The titans of the next century won't be the companies that simply create software or build hardware; they will be the ones that master the underlying current that powers it all: energy. They will be hybrid entities, bridging the worlds of decentralized value and centralized intelligence, effectively becoming what some have called MARA Holdings: The Bitcoin Miner Hiding An AI Empire (NASDAQ:MARA). The turbulence we see today isn't a warning sign to stay away. It’s the price of admission to witness the birth of a new species of corporation. It's going to be a wild ride, and I, for one, can't wait to see what happens next.