There's a fascinating story playing out right now, and it’s not the one you’re reading in the financial headlines. On the surface, it’s a classic corporate drama: China’s state-run mineral buyer tells its steelmakers to stop buying iron ore from BHP, one of the world’s mining titans. It’s a power play, a negotiating tactic over pricing terms. The kind of news that should send shockwaves through the market and crater a company’s stock.

But it didn’t.

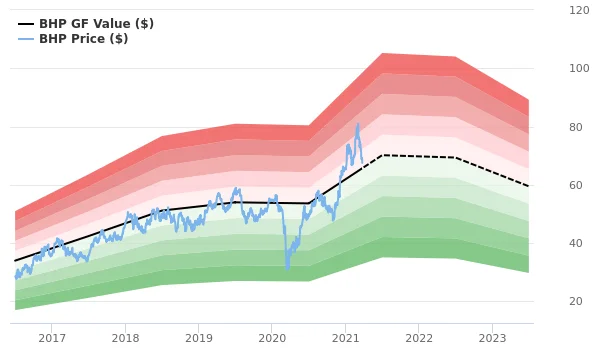

The `bhp stock price` barely wobbled. A dip, then a quick recovery. Investors, it seems, just shrugged. When I first saw the market barely flinch at this news, I honestly had to laugh. Not because it's funny, but because it's the kind of beautiful, counter-intuitive signal that tells you a much deeper story is unfolding just beneath the surface. This isn’t a story about a trade spat. It’s a story about the end of an era and the frantic, brilliant scramble for what comes next.

The Brittle Architecture of the Old World

For decades, the global resource economy has been built like a magnificent skyscraper resting on a single, massive pillar. That pillar is the relationship between raw material producers like BHP and industrial consumers like China. In this case, the pillar is iron ore. It’s been incredibly strong and profitable. But it’s still just one pillar.

BHP has a staggering "double concentration risk." Let me break that down. First, iron ore—the key ingredient in steel—accounts for a whopping 55% of the company's underlying EBITDA. That's Earnings Before Interest, Taxes, Depreciation, and Amortization, essentially a raw measure of the company’s operational profitability. Imagine if over half your personal income came from a single client. Now, for the second risk: the vast majority of that iron ore is sold to one country—China. Their competitor, Rio Tinto, faces a similar exposure, with its `rio stock` equally tied to this delicate dance.

This is the very definition of a single point of failure. It’s an architecture that’s incredibly efficient when everything is perfect, but terrifyingly brittle when it’s not. What we’re seeing with this "spat" isn't a crack in the relationship; it's a stress test revealing the inherent fragility of the entire structure. The old system, the one that powered the 20th century, is starting to groan under its own weight. And the smartest people in the room, like BHP's CEO Mike Henry, can hear it. The real question isn't whether this particular dispute gets resolved. The real questions are: What happens when the next one is bigger? And how do you redesign the skyscraper while you're still living in it?

The Great Resource Rewiring

This is the part that gets me excited. This isn't a crisis for BHP; it's a catalyst. This is the external pressure forcing a necessary and brilliant evolution. What looks like a threat is actually the spark for a paradigm shift.

Look at what BHP is already doing. They’re aggressively diversifying. They're moving into potash, a key component for fertilizer to feed a growing world. More importantly, they’re going all-in on copper. They bought Oz Minerals, boosting their copper production by 28% in three years. It's a clear signal that for BHP, the China-BHP spat reinforces M&A appeal. Why copper? Because copper is the nervous system of the future. You can't have an energy transition without it. Electric vehicles, wind turbines, solar panels, the entire grid infrastructure we need to build—it all runs on copper. This isn't just about hedging a bet against iron ore, it's about skating to where the puck is going.

This spat with China is accelerating that transition. It’s the universe screaming that the old model of digging up one thing and selling it to one place is over. This isn't just about the `bhp stock price` or a single quarterly report, it's about the entire global supply chain being forced to rewire itself in real-time for a future of green steel and electric everything—a future where new materials are king and reliance on a single customer for a single product looks like something out of the industrial dark ages. It’s a shift as profound as the move from whale oil to petroleum a century and a half ago. Nobody panicked then, either. They just got busy building the future.

Of course, this "great rewiring" comes with immense responsibility. How do we ensure this transition is just and doesn't simply create new dependencies or exploit new regions in the hunt for lithium, cobalt, and copper? The challenge isn’t just technological; it’s deeply human. We have a chance to build a more resilient, decentralized, and sustainable resource economy. Will we take it?

The Future Is Forcing Our Hand

Let's be clear. The market's calm reaction wasn't apathy; it was anticipation. It was the quiet, collective understanding that the game is changing. This isn't a story of decline; it's the prologue to a story of innovation. The pressure being applied by China is a gift, forcing companies like BHP to become what we need them to be: the architects of a more diverse and resilient material future. The old world isn't collapsing; it's shedding its skin. And what’s emerging is going to be far more interesting.