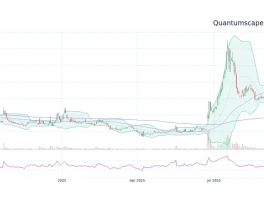

The stock chart for QuantumScape (QS) in late 2025 looks less like a financial instrument and more like an EKG readout during a moment of pure adrenaline. After months of trading sideways, the stock has ignited, surging roughly 170%—172% to be precise—year-to-date, tacking on about 30% in a single week in early October.

The narrative driving this ascent is undeniably compelling. A landmark partnership with materials science giant Corning. A public demonstration of its solid-state battery in a high-performance Ducati motorcycle. Renewed financial commitment from its primary backer, Volkswagen. For a pre-revenue technology company, these are significant, tangible milestones. They suggest a transition from a theoretical science project to a viable commercial enterprise.

The market has responded with unbridled euphoria, pushing the company’s valuation toward the $10 billion mark. But in my line of work, euphoria is a qualitative signal that demands quantitative scrutiny. When a company with no product revenue is suddenly worth more than many established industrial firms, it’s time to set the narrative aside and look at the numbers. And the numbers here tell a very different story.

Deconstructing the Catalysts

Let’s be clear: the recent news is positive. The strategic partnership with Corning to co-develop high-volume manufacturing for QuantumScape’s ceramic separator (the thin, solid electrolyte layer at the core of its batteries) is a major vote of confidence. Corning doesn’t partner with vaporware. This deal lends significant external validation to QuantumScape’s core technology and provides a credible path to solving one of the biggest hurdles in solid-state batteries: mass production.

Then there was the IAA Mobility show in Munich. You can almost picture it: the sleek Ducati prototype, silent on its stand, a small placard touting the 12-minute charge time (from 10% to 80%) as investors and journalists crowd around. This wasn't just a lab result; it was a physical demonstration in a vehicle, a critical step in silencing skeptics. It’s one thing to see data on a slide, and another to see the hardware it powers.

These events are not hype. They are real progress. But they are progress points on a very, very long road. The Corning partnership accelerates the potential for manufacturing scale; it doesn't generate a dollar of revenue today. The Ducati demo is impressive, but what does it tell us about battery degradation over 1,000 cycles under real-world conditions? What is the manufacturing yield for these prototype cells, and at what cost? The demo answers the question, "Can it work?" but leaves the far more important question, "Can it be made profitably at scale?" entirely unanswered.

A Glaring Valuation Discrepancy

And this is where the data presents a narrative I find difficult to reconcile. As of early October 2025, QuantumScape carries a market capitalization of over $9 billion. For this, investors get a company with a promising technology, powerful partners, and effectively zero product revenue. Its net loss for Q2 2025 was $114.7 million, with operating expenses running at $123.6 million. The company is burning cash, as expected for a deep-tech firm in the R&D phase.

Now, let’s introduce a point of comparison. Solid Power (SLDP), a direct competitor in the solid-state space, also has big-name automotive partners like Ford and BMW. It has already begun delivering prototype cells to these partners and even recorded its first revenue—around $6.5 million last quarter—from these early sales. Its market cap? Roughly $800 million, or about one-twelfth of QuantumScape’s.

This is a staggering discrepancy. While one can argue about the finer points of each company’s technology, is QuantumScape’s promise truly worth twelve times a competitor’s tangible, revenue-generating progress? The market is essentially pricing QuantumScape for flawless execution over the next five to seven years, a period in which it must scale an entirely new manufacturing process from pilot lines to gigafactories.

Investing in QuantumScape at its current valuation is like paying the full price for a successful Mars mission based on a single, perfectly executed engine test. The engineering is promising, but thousands of critical, failure-prone steps remain between the test stand and the destination.

This view isn’t just mine; it’s the overwhelming consensus of Wall Street analysts who cover the stock. The average 12-month price target sits around $5 to $6. That isn’t a minor correction; it’s a forecast for a 60% decline from current levels. Analysts aren't ignoring the positive news. They are simply weighing it against a valuation that has detached from any recognizable financial fundamentals, as detailed in reports like QuantumScape Stock Is Surging, But Analysts Warn It Could Fall 60% From Here. They see a company that won’t generate meaningful revenue until 2027 or 2028 at the earliest, yet is being valued as if that future is a certainty.

The Math Is Stubborn

QuantumScape has done an excellent job of building a powerful narrative and backing it up with legitimate technical progress. The company may well succeed and become a dominant force in the next generation of EV batteries. But the question for an investor today isn't whether the technology is promising; it's whether that promise is already over-priced into the stock.

With a $9 billion valuation, a multi-year path to revenue, and intense competition from both startups and incumbent giants like Toyota, the risk/reward profile at these levels appears deeply unfavorable. The market has priced in the destination, but seems to be ignoring the incredible difficulty of the journey. The current stock price is not an investment in a business; it’s a high-premium bet on a perfect outcome. And in the world of deep-tech manufacturing, perfect outcomes are exceedingly rare.