QuantumScape's Surge: A Data-Driven Look Under the Hood

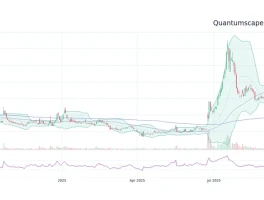

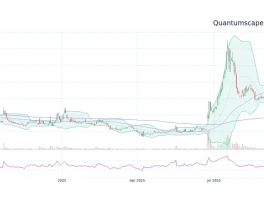

The market is currently captivated by QuantumScape. On Monday, shares [NYSE: QS] surged, at one point climbing over 15%—to be more exact, 15.44% according to live data—capping a month that has seen the stock soar over 70%. The narrative is compelling, a perfect storm of positive catalysts that seems to validate the long-held promise of a solid-state battery revolution. This has left many investors asking: QuantumScape’s Stock Skyrockets: Buy or Wait?

On the surface, the bull case is straightforward. The company has announced a joint venture with Murata Manufacturing to mass-produce its innovative ceramic separators, a critical step toward scaling up. Another alliance with Corning aims to refine those manufacturing processes further. Add to this a geopolitical tailwind, with a US-China trade spat over critical minerals suddenly making domestic battery technology a matter of strategic importance. To top it all off, speculative whispers of a partnership with Panasonic are fanning the flames. These factors help explain Why QuantumScape Stock Soared Monday Morning.

This is the story the market is buying. It’s a clean, forward-looking narrative of technological progress meeting geopolitical necessity. But my job isn’t to repeat the story; it’s to scrutinize the numbers behind it. And when you start digging into the data, a second, far more complicated narrative begins to emerge.

A Tale of Two Conflicting Datasets

The excitement around the partnerships is not unfounded. Moving from the lab to mass production is the single greatest hurdle for any deep-tech company, and these deals with Murata and Corning are tangible de-risking events. They represent a credible path to commercialization. The market’s reaction, pricing in a higher probability of success, is logical. The social media chatter, which I view as a qualitative sentiment indicator, reflects this palpable optimism, with discussions on X focusing on the transformative potential for the entire electric vehicle industry.

But while the market is looking forward, the company’s internal metrics and executive actions seem to be telling a different story.

First, let’s look at the financials. While QuantumScape boasts a robust current ratio of 16.4, indicating it has more than enough liquid assets to cover short-term liabilities, this is a measure of solvency, not success. It simply means the company has a long runway. The destination, however, remains uncertain. Profitability is nonexistent, with a pretax loss of over $114 million and a return on assets of a staggering negative 44.82%. This isn't unusual for a pre-revenue tech company, but it provides a stark reminder of the cash burn required to reach the promised land.

Then there are the Wall Street analysts, who are paid to model these future cash flows. Their consensus is… bleak. We have seen two price targets issued in the last six months, with a median target of just $6.75. Goldman Sachs, for its part, reiterated a "Sell" rating back in April. This creates a massive chasm between the current trading price (around $17) and the sober, spreadsheet-driven valuations of professional analysts.

And this is the part of the report that I find genuinely puzzling. The most telling data point, and the one that directly contradicts the market’s euphoria, is the insider trading activity. Over the past six months, QuantumScape insiders have executed 29 open-market trades. Of those, 29 were sales. Zero were purchases. The Chief Technology Officer, Chief Development Officer, Chief Financial Officer, and Chief Legal Officer have all been systematically selling shares. In total, insiders have sold shares for an estimated value north of $45 million.

What are we, as outside observers, supposed to make of this? When the people with the most intimate knowledge of the company's technology, manufacturing progress, and partnership details are consistently reducing their personal holdings, it's a data point that cannot be ignored. Are they simply diversifying, or are they signaling that the current valuation has outrun the company’s near-term prospects?

The Narrative Disconnect

This leaves us with a profound disconnect. On one hand, you have a powerful external narrative fueled by press releases, geopolitical trends, and legitimate technological progress. On the other, you have a sobering internal narrative told through negative profitability, bearish analyst targets, and an uninterrupted stream of insider selling.

The current stock price is, therefore, a bet. It’s a bet that the external story will ultimately overwhelm the internal data. It's a bet that the partnerships with Murata and Corning will convert potential into profit faster than the cash burn depletes the balance sheet. And it's a bet that the executives selling their shares are wrong about the timing, if not the ultimate outcome.

The technology may very well be revolutionary. QuantumScape could, in time, change everything. But the data right now suggests that the market’s enthusiasm is pricing in a level of certainty that simply doesn't exist yet—and one that the company's own leadership doesn't appear to fully share.